unrealized capital gains tax bill

Web The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of. Web The Disadvantages of Cryptocurrency Is Bitcoin a Good Investment.

Will The Unrealized Capital Gains Tax Targeting Billionaires Pass

Web When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

. Web WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized. Web Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. Web The largest part of the tax bill will be upfront.

Web As of 11152022 no related bill information has been received for HR5814 - Prohibiting Unrealized Capital Gains Taxation Act. Web House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion. Web Text for HR5814 - 117th Congress 2021-2022.

Web Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. Web For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples. Web The Problems With an Unrealized Capital Gains Tax.

If it passes what is the point in investing in the stock market. Web A tax on unrealized gains would harm the economy. Web The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of.

A bill must be passed by both the House and Senate in identical form and then be signed by the President to. Web Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark. Web The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three. Web Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring. If you hold an asset for less than one year and sell for a capital gain.

Web Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis. Web Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes.

Entry Level Finance Jobs Import and Export Regulations and Trade Compliance How to Close. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid. Subjects 1 Subject Policy Area.

Prohibiting Unrealized Capital Gains Taxation Act. 5814 is a bill in the United States Congress.

U S President Biden Unveils Unrealized Capital Gains Tax For Billionaires Swfi

Taxing Unrealized Capital Gains A Bad Idea National Review

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

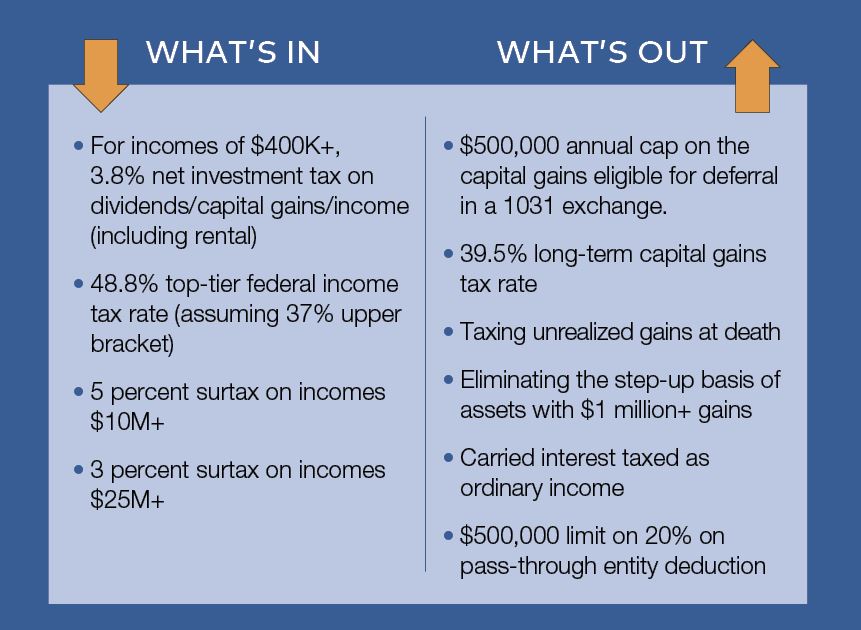

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

:max_bytes(150000):strip_icc()/TermDefinitions_Capitalgain_finalv1-b039981b63214a4692683b5f10661a01.png)

Capital Gains Definition Rules Taxes And Asset Types

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Dealing With Unrealized Capital Gains Acm Wealth

What Are Unrealized Capital Gains Who Pay Taxes For It As Usa

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax Hike And More May Come Just After Labor Day

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Beware Of A Biden Tax On Unrealized Capital Gains Realclearmarkets

Crypto Tax Unrealized Gains Explained Koinly

Strategies For Investments With Big Embedded Capital Gains

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas